How to fill in tax information in Google AdSense? Complete information

March 10 turned out to be a dark day for YouTubers as Google broke the bad news for YouTubers. From now on, every Pakistani YouTuber will have to pay tax on AdSense earnings in the US, that is, if a channel has an idea from the US, they get 15 to 24 income from those ideas. To form a tax.

If there is a YouTube that fills in its tax information on Google AdSense, it will have to pay 15% and if it does not, it will have to pay 24% of the entire income as tax. If you have tax information and you do not know. How to fill in tax information in Google AdSense? Strictness will get the full information here.

How to fill in tax information in Google AdSense?

If you are a YouTuber and are eligible to make money on your channel, you have received notifications about it on the channel as well as information about YouTube's new tax on mail and AdSense. If you want to fill in the tax information instead of 24, you have to pay 15% tax.

That is, understand that if you earn $ 100 from the US on your channel and you do not provide tax information, you will have to pay 24 pay as tax and if you provide the information, you will have to pay 15 in. Taxes will be paid and the remaining 85 will be credited to your account. By providing tax information, you can save up to 9% tax.

In that case, if you have to pay taxes, follow the guide mentioned here.

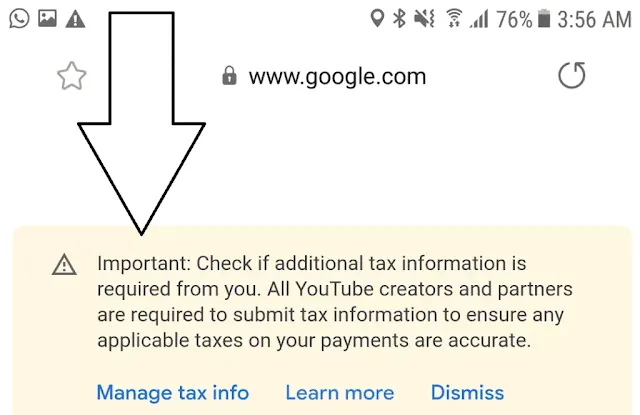

Step 1. In Google AdSense, by directly clicking on this notification or by going to the payment options, the notification will be received anyway and you will see the additional tax information button here. At the same time, the process of submitting your tax information will start and you will click on the button.

Step 2. When you click the button, you'll need to log in with Gmail from where your AdSense account is. So that the process of filling out the form can begin.

Step 3. Now the US Tax Information Form process will start in front of you, first you have to choose what your AdSense account is like, ie individual or non-individual. If you take AdSense revenue directly into your personal savings bank account, your account will be individual and if you have registered your business and take AdSense revenue into your account, it will be a non-individual account.

After selecting the account, click the Next button.

Step 4. Now you will ask a question whether you are a US citizen, then you have to select the number here and then you have to select W-8BEN in the form type and go to the next step.

Step 5. Now the W-8 BEN form will open in front of you, where you have to give information about name, and citizenship (select Pakistan from the list).

Then you are called Taxpayer Identification Number TIN, but in Pakistan we know it as CNIC (National Identity Card Number). So you have to enter your CNIC number in foreign TIN here and then click on Next button.

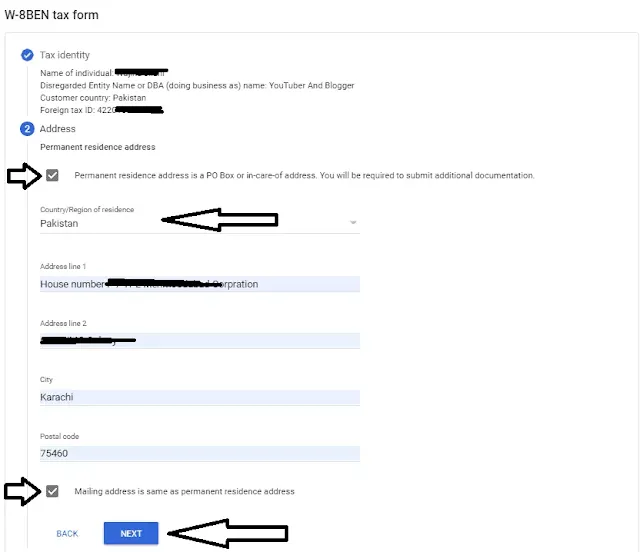

Step 6. In the next option, you have to fill in the address details.

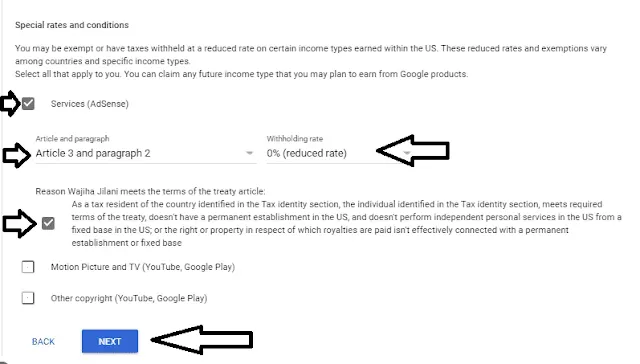

Step 7. Now here you will be asked about the tax agreement and you have to choose yes here and choose the name of the country.

Step 8. Here, by previewing all the information you have filled in your form, you can see if it is correct. If there is an error, you can correct it before submitting the final, and if all is well, click the Next button.

Step 9. Now you have to enter your name and then select the first option and click on the next button.

Step 10. Here you will find two options.

1. Have you provided any services in your USA? So you don't have to fill in the number, if given, you can fill in yes.

There are two options, if you have never taken money from a bank before AdSense, select the first option and if it is, then select the second option.

Step 11. As soon as you submit the form, a page will open and you will see the approved mark, you have to pay attention to one thing, this form has to be filled before 31st March.

If this article is helpful to you don't forget to comment my post.

Read more about "How to backup contacts and messages on android?

0 Comments

Thank you for connecting me :) as soon as I will read message will get back to you for sure.

Thank you :)